Sustainability is more than a buzzword for companies in the clinical supplies industry. Learn more about the solutions to make a difference

How to navigate the challenges of a changing Chinese market

Rapid economic and demographic changes are causing a boom in the Chinese market for pharmaceuticals. This offers opportunities for pharma companies, but the landscape is complex, and understanding the changes will be key to success in the region.

China has become the world’s second-largest pharmaceutical market, making it a market with enormous potential for international pharma companies. China’s senior population is growing: more western lifestyles combined with better overall health has the positive effect that life expectancies are improving but associated lifestyle illnesses like heart disease and diabetes are on the rise. This poses a challenge for healthcare services in the country.

The government is already taking measures to develop its healthcare system to handle the increasing demand. The “Healthy China 2030” plan was a sign of its commitment to improving the health of the nation, and the plan is supporting the growth of this industry in a number of areas, including pharmaceutical distribution.

As China adapts to its environment, challenges arise for foreign pharma companies newly navigating the Chinese pharma market looking for local partners.

A fragmented market

China’s pharmaceutical distribution market is currently dominated by small-scale, domestic distributors, often focussed only on their local area. In these areas the top wholesalers hold less than one third of the market share.

Mergers and acquisitions have also been encouraged by the Chinese government. Large wholesalers are absorbing smaller distributors in order to increase their overall market share and strengthen their capabilities in smaller cities and rural areas. This market consolidation is leading to shorter supply chains, better enforcement of industry standards and regulations, as well as reduced costs. Working with a partner who understands this shifting market, and can advise on the best solutions, is key for pharma companies wishing to operate in China.

Reducing risk and costs

A multi-tiered distribution structure means products change hands multiple times before reaching a patient in need. This increases both cost and risk, with multiple margins added and increased opportunity for counterfeits to enter the supply chain.

In an effort to reduce the risks and costs, the government has started to implement a two-invoice system: one invoice from the manufacturer to the distributor, and one invoice from the distributor to the buyer. Limiting the supply chain length will make the process more transparent. However, foreign pharma companies needing access to a wide range of products will need to partner wisely: a distributor who cannot access the products required will not be able to work with other distributors to increase their sourcing capabilities.

Logistics challenges

China suffers from an unevenly developed logistics network, mainly due to its vast size and varied geography. Consolidation of distributors will add pressure on existing logistics service providers which are not yet optimized for handling cold-chain products, nor for complex inventory and delivery requirements.

Pharma companies are increasingly looking to partner with distributors who offer full-service logistics solutions to better control their supply chains and reduce risk. This increased demand is providing the catalyst needed to encourage distribution companies to improve their logistics service offerings.

The landscape for international pharma companies wishing to operate in China is not a simple one, but finding a partner who can help navigate the rapid change and development currently underway will be critical. Early-stage consulting, reliable access to products, and full-service logistics solutions will provide the foundations international pharma companies need to make the most of China’s opportunities.

Inceptua Group is an international partner for clinical trial services, medicines access, and commercial products. Inceptua Pharmaceutical Technology Services (Shanghai) Co., Ltd. established in China can support Pharma companies starting to operate in China.

Latest News and Insights

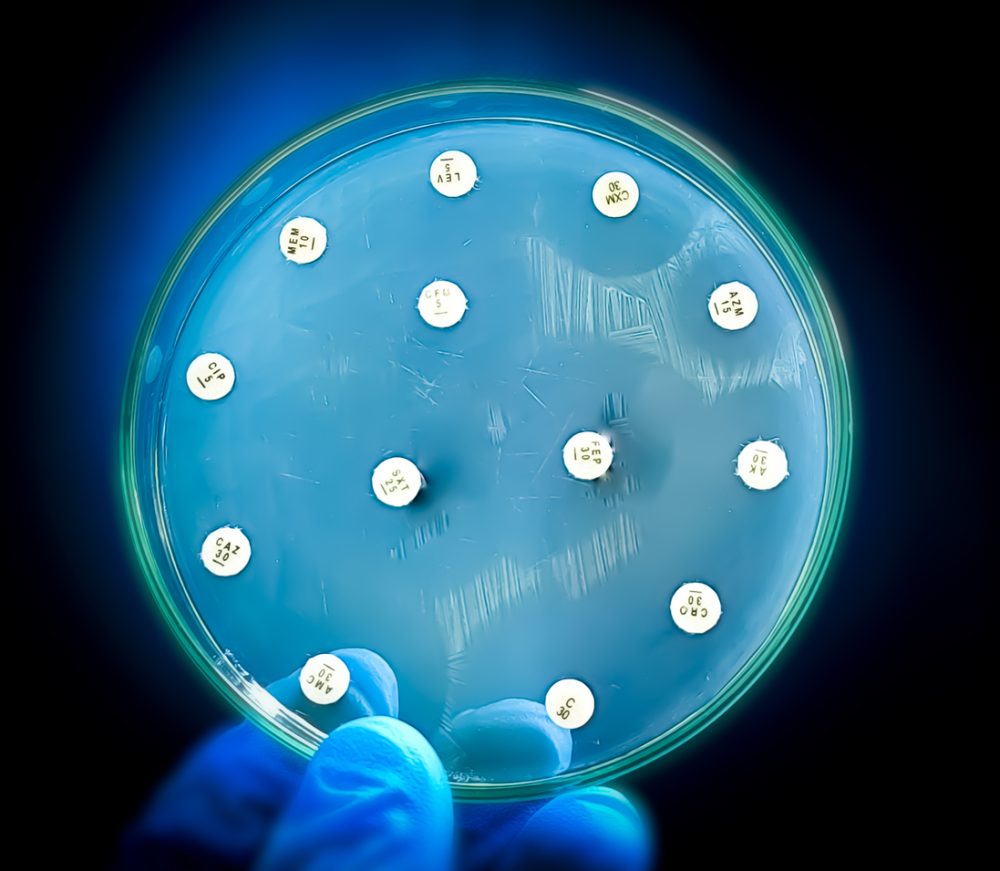

Antibiotic resistance is the third leading cause of death, globally, claiming almost 5 million lives every year, with this projected to increase …

In this Q&A, Paul Stanton delves deeper into the considerations and strategies for successfully running EAPs in sanctioned countries …