Sustainability is more than a buzzword for companies in the clinical supplies industry. Learn more about the solutions to make a difference

Expanded Access as a Key Component in the Development and Launch Process

On February 20, 2020, Inceptua hosted a webinar on industry trends in pre-approval access to medicines. You can access the on-demand webinar here: View the full webinar for free here

Below you will also find a post-webinar Q&A capturing all questions and answers provided at the webinar + relevant white papers and other supporting material. If you want to get in contact with one of our pre-approval access experts, don’t hesitate to contact us: info@inceptua.com

About the webinar

Expanded access to medicines (pre-approval access, early access, compassionate use, named patient supply) is becoming more and more a part of the standard development and launch process of bringing a pharmaceutical product to market. The focus of pipelines on rare diseases and oncology, combined with a heightened awareness of access delays, is driving this change from Top 10 Pharma down to small biotechs. Done well, expanded access can help patients access your medicine sooner, can contribute to a positive corporate reputation, allow data to be captured from the first patients outside of a trial setting and gain early market share. Done badly, expanded access can damage goodwill amongst patients and physicians, cause supply chain and regulatory issues and can negatively impact your commercial roll-out and reputation.

This webinar will provide a current overview of the Expanded Access sector, including the major policy developments and shifts in approach, alongside a view into the future. It will review the evolution, from the initial rationale behind Expanded Access to how industry now views these activities as core aspects of bringing a product to market. It will cover how best to develop custom programs, tailored to the specifics of your product and your commercial/corporate plans. A detailed analysis of how to use Expanded Access globally to pave the way for successful commercial launch will be provided.

Opportunities, obstacles, politics and competitive interests relevant to Expanded Access will be highlighted. An overview of how and when to consider Expanded Access to a particular asset, based on criteria demonstrated to be central to successful programs will be presented.

This webinar will examine the state-of-the-art in Expanded Access, as showcased at the recent Expanded Access 3.0 Summit in Washington DC. The speakers, including global authority on Expanded Access, Paul Aliu (Novartis) will assess and contextualise the claims and developments in this space, providing insight and guidance for anyone with an interest in early patient access to medicines.

Presented By

Stuart Bell, VP Consulting, Inceptua

Stuart Bell has more than 20 years of healthcare consulting experience, with a particular focus in unlicensed medicines and pre-approval access. Stuart is responsible for Inceptua’s consulting covering strategy and policy, real-world evidence, communications and market access. Prior to Inceptua, Stuart pioneered the development of global corporate strategies on pre-approval access and developed the first pre-approval-specific EDC for real-world data collection at Idis/Clinigen.

Paul Aliu, Global Head Medical Governance, Novartis

Paul Aliu is in the cross-divisional Chief Medical Office at Novartis, with responsibility for the oversight, processes, training and systems for compassionate use/expanded access, and post-registration medical programs (e.g. Investigator initiated trials , research collaborations, non-interventional studies, registries and local Phase IV studies). He has almost 20 years’ experience in the Pharma industry across multiple therapeutic areas and functions. Prior to joining the pharma industry, he trained and practised as a clinical pharmacist. He also served as an industry representative on the WHO/Roll-Back Malaria (RBM) case management working group over many years, and has managed various partnerships (Public-Private & Private-Private).

Paul is a regular speaker at various forums and conferences on global health and pre-approval access, and has been engaged with various stakeholders (including regulators, academia and bioethicists) in advancing this space to better address patients’ needs.

Stuart Bell

Paul Aliu

Post-Webinar Q&A

1. Do you see there being a role for bioethicists in pre-approval access?

I would argue only in exceptional cases where there is a contentious or ethical component e.g. where there is a significant unmet need and where production and capacity is limited. In instances where bioethicists are involved, their role should be limited to ‘advisory’ as the final decision making should still remain with the manufacturer.

2. Can a program ever be profit-generating?

Generally, no. And we would caution against opening a program if revenue generation is the main driver.

3. What’s the importance of having a project lead in the company to be point of contact for any vendor? How much time would this typically take as a share of FTE?

I would argue that having someone as a point of contact to escalate issues internally and liaise with any vendor is crucial. How much time of that person’s role it would take depends on the size of the program.

4. What are the pros and cons of managing this internally versus outsourcing to a vendor?

I would say the pros are: tapping in to someone else’s specialist regulatory knowledge, and taking the burden off internally to allow you to focus more on the development and launch of a product. The cons are: if not selected wisely and the program is badly managed, your key prescriber group and your patient community can have a very negative first experience of you as a company.

5. How long, roughly, does it roughly take to set up a program?

This depends on many factors, but the key one is speed of response of the manufacturer to the many questions that arise during set up. It is possible to set up a program within 3 months, but this is exceptional. 6-9 months is more reasonable.

6. What sort of factors would dictate whether to charge or not, which countries we should open a program in etc?

There are many factors to be considered which inform these decisions, and they depend largely on your corporate and commercial objectives as a manufacturer. Are you allowed to charge for the product in that country? Can you afford to provide product free-of-charge? Do you want to? Is your intention to reach as many patients as possible, or only to enter into countries where you intend to commercialize? Once you have an understanding of what your intentions behind pre-approval access are, then these decisions tend to fall into place more easily.

7. Can a country qualify for pre-approval access if the manufacturer has no intention to commercialize the product in the future?

In the majority of countries this is possible. Many manufacturers use such mechanisms as a way to allow supply into countries they never intend to commercialize in. A few countries will expect the manufacturer to file in that country if they do open a program.

8. What is the regulation when to terminate pre-approval access in a region or country? Until regulatory approval?

This varies by country, so there is no one answer here. However, in most instances, pre-approval access should be terminated on obtaining regulatory approval and having the product commercially available. In some countries you can continue pre-approval access until reimbursement has been agreed. In general though, as soon as commercial pack becomes available in that country, all patients on the program will transition to that commercial supply.

9. Is that correct that the drug has to compete Phase III, or can also be earlier stage?

Manufacturers can make product available at any stage of development. In rare diseases it is not uncommon to make product available earlier in the development lifecycle. The decision should be driven by the availability of sufficient evidence to suggest a positive benefit-risk profile and/or a well understood safety profile to allow for informed use of the product in a patient.

10. Can pre-approval access be used for other indications not tested?

Yes. It is the prescribing physician’s responsibility to make a clinical judgement as to whether a product may benefit one of their patients, even if that product is not being investigated for that indication. However, the manufacturer decides whether or not to permit access – they are not obligated to.

11. Do healthcare professionals that use pre-approved drugs in their patients, submit any safety reports (SAEs, SUSARs) to local/global regulatory authorities, e.g. FDA in the US?

Yes. Safety reporting is mandatory in all countries under pre-approval access regulations. The specifics of who must be informed and at what frequency is very much country-specific.

12. What is the right and liability of manufacture to patients with such access?

The manufacturer has the right to either grant or deny access, and can make restrictions around which patients, physicians and centres can access a product. Liability, though, lies with the prescribing physician.

13. Is there a publicly available database/central repository of previous/ongoing pre-approval access treatments?

Not of all programs, no. In the US there is an expectation that any entry on clinicaltrials.gov will be amended to state that an access program is in place. Although it is not clear whether all manufacturers do this. Some national agencies (e.g. France, Germany and Italy) list all products being made available pre-approval on their websites.

14. Why does “A fear of uncovering unanticipated side-effects” deter manufacturers from offering PAA? Is it an investor disincentive? Would they not want to find out earlier rather than later if a product caused SAEs?

It is definitely important to fully understand the safety profile of a compound prior to filing/approval, and the pre-approval access program should contribute to that knowledge. However, manufacturers are cognizant of the fact that in pre-approval access they are often treating the ‘sickest of the sick’, which is a different population from their clinical trials, so do have concerns that they may pick up safety signals not observed in the trials. The FDA has gone out of its way to reassure manufacturers that their assessment of AEs in pre-approval access in done within the context of pre-approval access, and there is no history of a clinical development program discontinued as a result of findings from a pre-approval access program.

15. What do you think is the biggest challenge for ATMPs to become part of a pre-approval access?

The challenges with pre-approval access for ATMPs are multi-factorial but mainly related to the complexity of the treatments i.e. complex manufacturing with related high costs, limited supplies, requirement for certified expert treatment centres (usually not available in every country), the need for close and extensive patient monitoring and follow-up etc. Given that these ATMPs are relatively new therapies, as a lot of the factors highlighted above should improve over time.

16. Is there enough impact of pre-approval access in the industry to merit revisiting new product forecasting methodologies?

I doubt it. Uptake into a program depends on a number of variables, and is very much asset/product specific e.g. level of unmet need, physician perception of the product and awareness of the product. Some programs have much higher than anticipated uptake, and others much lower uptake. However, it is important to continually assess these variables during the clinical development program and make the necessary adjustments re product forecasting as required.

17. Who are the current key stakeholders within drug developers vs who should be the key stakeholders in relation to pre-approval access programs, especially if a more integrated approach is desired?

We advocate a cross-functional involvement. Key stakeholders should certainly include: clinical, medical, regulatory, supply chain, legal and advocacy. At a later time point in the program, market access, commercial and HEOR teams may become involved, however the medical considerations should remain primary, with the Medical team in the lead for these programs.

18. From a supply chain perspective, is medication provided as Direct to Patient shipments, each time a patient appears? Or supplied as a “program” that amasses a certain stock to the country, were several patients could benefit?

Generally, it is a ‘per patient’ supply. It is uncommon for it to be direct to the patient as almost all regulations require that the request for product be placed by a Healthcare Practitioner (HCP), and in most instances the treating physician. As products being made available pre-approval are often specialist products for disease areas with high unmet need, they are typically administered in an in-patient setting in a tertiary centre, with the products shipped to the treating physician/pharmacy

19. Do you foresee integration between market access (P&R, HEOR) and pre-approval access programs, especially in light of the continuing trend to collect data?

Yes and no. Pre-approval access programs are generally managed within the medical organization, and with the continuing trend for data collection, the medical teams will need to collaborate more closely with the clinical teams as well as the market access teams re the utility of the data to be collected. However, market access considerations should generally not be the driving force behind any pre-approval access.

20. Is it acceptable to open expanded access only to subjects who had participated in (and derived benefit from) a study with an investigational drug that may not be further developed (i.e., sponsor wishes to end the study)?

This is entirely down to the manufacturers’ discretion and what is allowed as per the local regulations in the relevant countries. Certain countries e.g. Brazil, have regulations and mechanisms for post study drug supply, which are distinct from ’expanded access’ and can be utilized in such instances. In some other countries, the ‘expanded access’ mechanism may be utilized for post-trial access (even when a development program has been discontinued), but will need to be assessed by the HA, treating physician and manufacturer on a case-by-case basis.

Learn more:

Read our white paper: Expediting Access to Rare Disease Therapies in Europe

Already considering an access program for your asset? Via ASK Inceptua we commit to answering 10 questions on pre-approval access, free-of-charge, with no obligation. Click on the below video to learn more.

About Inceptua

Inceptua is a pharmaceutical company and service partner spanning throughout the product lifecycle – from comparator sourcing for clinical trials, through early access programs to licensing and commercialization for products.

We partner with life science companies of all sizes, drawing on over 20 years of industry experience. Our pharma and biotech offering includes registration and commercialization of products through in-licensing and flexible partnerships. We have leading expertise in strategy and operational implementation of pre-approval access programs making pharmaceutical products under clinical development available for patients and Inceptua’s clinical trial services business offers high quality clinical comparator sourcing and manufacturing services with an agile global supply chain to ensure that products are delivered exactly when needed.

Inceptua Medicines Access is a business unit of the Inceptua Group. It offers full access solutions for the design, implementation and delivery of Pre-approval and Medicines Access Programs on behalf of biopharmaceutical companies.

Inceptua has global operations with local offices across Europe, USA, and Asia.

Latest News and Insights

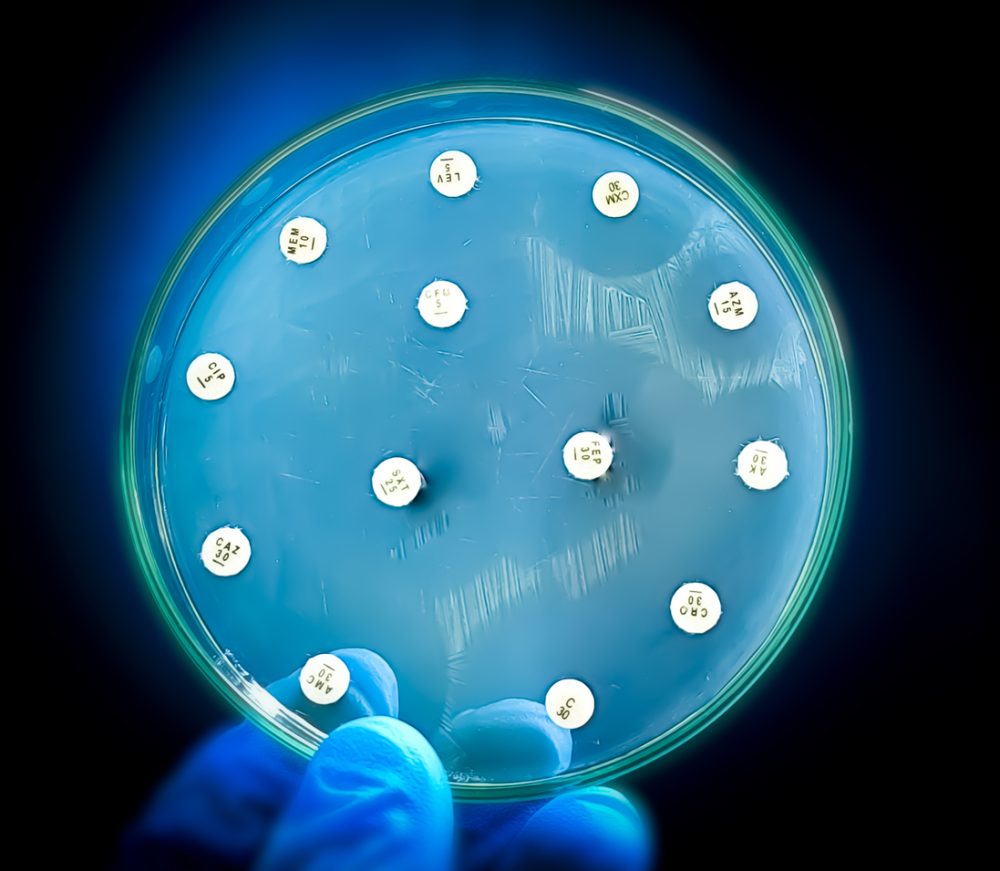

Antibiotic resistance is the third leading cause of death, globally, claiming almost 5 million lives every year, with this projected to increase …

In this Q&A, Paul Stanton delves deeper into the considerations and strategies for successfully running EAPs in sanctioned countries …