Sustainability is more than a buzzword for companies in the clinical supplies industry. Learn more about the solutions to make a difference

Commercialize and partner successfully in Europe and the Middle East

Dr. Stefan Fraenkel, Executive Vice President, Inceptua Pharma.

Understand how to commercialize via partnering in Europe and other markets outside of the USA. Dr. Stefan Fraenkel, Executive Vice President, Commercial Products, Inceptua shares his insights on maintaining strategic options and maximizing value as a small or midsized US pharmaceutical or biotech company.

Are you a small or midsized US pharmaceutical or biotech company considering expanding into other regions such as Europe and the Middle East? There are several complex challenges inherent within regional expansion but for each day your product is not present in other regions, it isn’t creating optimal value – neither for patients nor shareholders.

To introduce your product successfully in Europe there are several approaches, each with its pros and cons. Before considering which approach suits your business best, you have to ask yourself what you really want to achieve. Do you want to establish yourself as a global or regional player? Or do you foresee a potential divestment of the product or exit of the company? If you are looking for a mid to long-term exit or plan to commercialize later, maximizing value creation usually means keeping the ownership, or keeping the option to regain ownership, of product rights in at least the US and Europe. For this you need strategic flexibility in your partnerships. It is essential to match the preferred commercialization set-up with the right partnership structure, as it will be critical in realizing your goals, and generating the most value from your product.

Choose the approach that suits your business goals

Entering Europe and the Middle East can be highly attractive if successfully executed. Generation of early product revenues will both provide cash flow, and demonstrate commercial ‘proof of concept’. The question, however, is what are the options for your company to successfully launch in these markets without putting your business at risk with significant upfront fixed costs or losing focus on the core business (i.e. your US launch and/or R&D focus), while still retaining strategic flexibility for the future?

The three main approaches for a product launch in e.g. Europe:

- Establish your own, full infrastructure in all countries

- Engage in a partnership in ‘Tier II’ markets, whilst creating full infrastructure in ‘Tier I’

- Engage in a partnership in all countries

The first option of establishing your own commercial operations may sound attractive as it offers the potential for full control over your product and the value creation. History shows, however, that very few firms succeed with this approach. This opportunity requires major upfront investments, typically two-to-four years ahead of any revenue being generated, and assumes that your product has a significant commercial volume that will one day cover the investments. Building your own commercial platform may be an attractive option if the company has a portfolio of products with enough revenue to fully support an infrastructure but is usually less viable while there is only one commercial product. In addition, there is substantial operational risk associated with establishing a multi-country commercial infrastructure from scratch.

The right partnership offers flexibility

A key alternative is to launch your assets in partnership with other companies, such as a larger pharma company or a company specialized in commercialization and partnering. Both have their pros and cons but in order to retain strategic flexibility and avoid a lock-in, the latter is preferable in cases where you want to potentially exit or establish yourself in the future. Partnering with several firms will require an extensive pan-European coordination due to the challenges posed by reference pricing and parallel trade. Therefore, it is advisable to choose one partner with the experience and know-how in the entire European region.

Finally, matching the right partnering structure with your commercialization strategy is crucial. The selection of which of the four generic partnering structures is best for your business is very dependent on your company’s ultimate goal:

- Out-license or divest the product rights with a defined territory – including upfront, milestones, and royalty.

- Revenue sharing – potentially including an option for claiming product rights back for strategic flexibility.

- A combination of fee-for-service and revenue sharing – potentially including an option for claiming product rights back for strategic flexibility.

- Fee-for-service or consulting support with commercial launch planning and execution.

For a more detailed overview of potential partnership and commercialization structures, you can also read the white papers: The challenges of Launching a product in Europe and The art of matching your Commercialization Strategy with the right Partnering Set-up.

To request the white papers, for more information and/or advice, you are welcome to contact the author Dr. Stefan Fraenkel: stefan.fraenkel@inceptua.com

Latest News and Insights

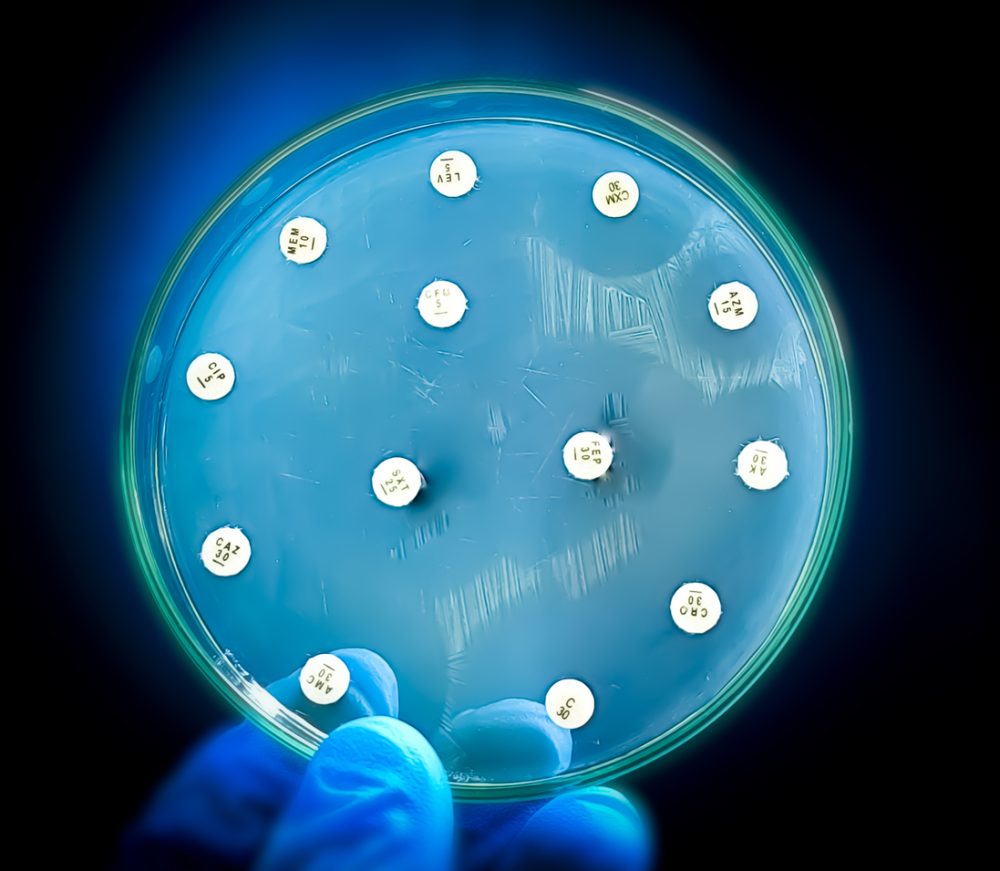

Antibiotic resistance is the third leading cause of death, globally, claiming almost 5 million lives every year, with this projected to increase …

In this Q&A, Paul Stanton delves deeper into the considerations and strategies for successfully running EAPs in sanctioned countries …